Based on our corporate philosophy, we believe that increasing our corporate value, supporting the manufacturing for tomorrow, and contributing to society through our corporate activities, are ways to meet the expectations of all our stakeholders, including our shareholders and business partners.

Updated on July 25, 2025

Corporate Philosophy

“Integrity” is Shinsho Corporation's Company motto. We are committed toward securing prosperity for our clients and shareholders through the creation of new values.

Core Values

-

1. Contribution to tomorrow's manufacturing

-

2. Corporate activities with compliance

-

3. Activities in global environment

-

4. Corporate culture respecting diversity

-

5. Realization of personal growth

Management Structure

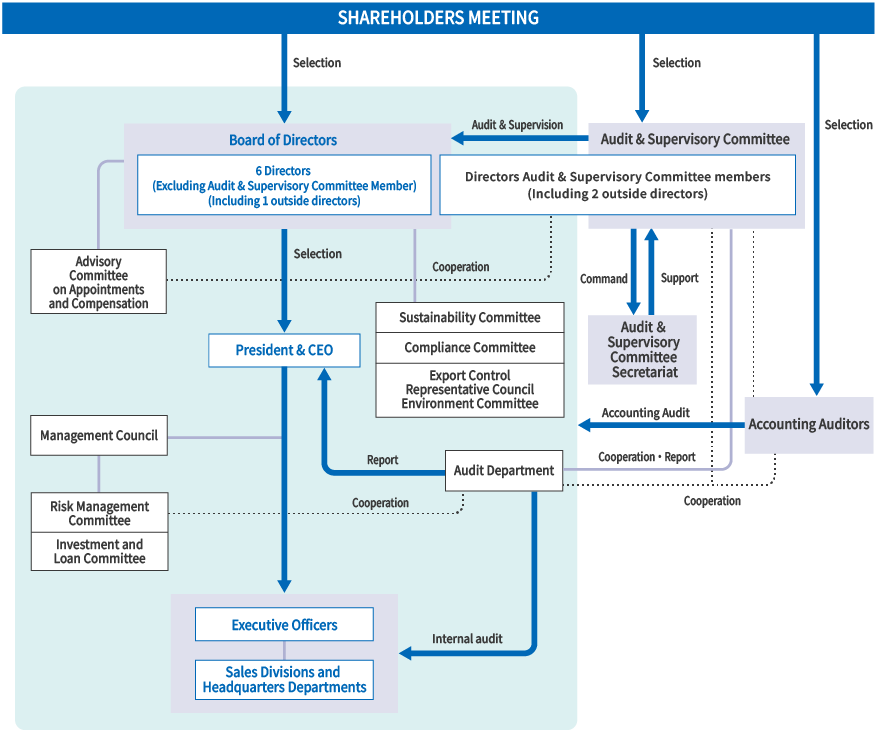

The Company has set as its standard that Independent Outside Directors comprise over one-third of the Board of Directors’ members. The functions of the Board of Directors will be strengthened to make management decisions and provide oversight, with the formulation of the basic policies of the Shinko Shoji Group's management, management oversight, and the formulation of the basic policies of internal control and monitoring of their implementation. It also serves to strengthen management decision making and supervisory functions, while promoting swift and streamlined management execution within a framework in which Executive Directors and Executive Officers are tasked by the Board of Directors to carry out business execution functions based on the authority delegated by the Representative Director.

Furthermore, our company has transitioned to a company with an audit and supervisory committee, in which the majority of committee members are external directors, with the aim of achieving more transparent management by having the audit and supervisory committee oversee and audit the legality and appropriateness of business execution, and to build a system that can and to build a system that can respond more accurately to the expectations of stakeholders in Japan and overseas. By transitioning to a company with a board of auditors, the authority to make operational decisions by the board of directors can be delegated to directors, which will further speed up management decision-making and execution.

In addition, by establishing a Nomination and Compensation Advisory Committee, chaired by an independent outside director, as an advisory body to the Board of Directors, we ensure the objectivity and appropriateness of the appointment of management and the content and procedures of management compensation.

Basic Policy of Capital Policy

The Company’s capital policy is to make investment for sustained growth and maintain capital adequacy that can tolerate risks in order to raise shareholders’ value over a medium to long term.

In order to achieve the target level of capital adequacy while maintaining stable profit returns to shareholders, we regard the capital adequacy ratio and return on equity (ROE) as important management indices. We announce these target values, enhance capital adequacy and aim to establish an optimum capital structure.

Cross-Shareholdings

Concerning publicly listed shares held by the Company, in addition to the propriety of holding such shares considering its operating policy, the Company confirms and verifies that the combined total of profit and dividends gained by transactions with the issuing company surpasses the Company’s weighted average cost of capital (WACC), specifically, the economic rationality, and that those shares determined to be of little significance for the Company to hold are promptly sold.

Basic Policy of Related Party Transactions

n conducting transactions with related parties, the Company preliminarily deliberates prior to the resolution as necessary, and follows appropriate procedures to prevent transactions that would impair the common interests of the Company and its shareholders. One such effort is a transaction within the range of regular market prices accepted on the basis of trading common sense. At internal monitoring, we audit the appropriateness of the decision on such transaction from the aforementioned perspective.

In addition, regarding transactions that would cause conflict of interests between the Company and a director, the Company preliminarily seeks an approval at the Board of Directors, and in principle, makes the director report the content of such transaction to the Board of Directors annually in order to examine the adequacy and appropriateness of such transaction.

Functioning as the Asset Owner for Corporate Pensions

In order to mitigate future risks associated with corporate accounting and to support independent asset formation in line with economic rationality and the life plans of each individual employee, the Company has adopted a defined contribution pension plan. Under the plan the Company employs a highly specialized financial institution for a period of management, and regularly provides management education for employees.

Roles and Responsibilities of the Board of Directors

According to its internal regulations (rules and regulations covering the Board of Directors, Management Committee, management authority, executive officers, and others), the Company clearly defines the scope of decision making at the Board of Directors and delegation of tasks to be executed by management. This is the basis for executing management and supervision at the Board of Directors, as well as the performance of duties by Executive Directors and Executive Officers. In this way, there is a separation between decision making and supervision from business execution, and management is carried out properly and promptly.

CEO Succession Planning

The Company’s CEO is expected to demonstrate the qualities of leadership in carrying out and accomplishing management plans, and raising corporate value, based on the Company’s Corporate Philosophy and Core Values. The Company selects a suitable candidate for this management position in the Shinsho Corporation Group, and this candidate’s eligibility is deliberated upon at the Advisory Committee on Appointments, which then submits the results of its deliberations to the Board of Directors, and based upon this the candidate is determined.

Basic Policy of Nomination and Remuneration

In selecting candidates for directors, the Company selects human resources with quality, knowledge, and experiences as the management candidates, who are appropriate for the shareholders and other stakeholders to entrust the Company’s management, in order to achieve our management goal of being a global trading company at the core of the Kobe Steel (KOBELCO) Group.

In determining remuneration, it is important to provide the management members with incentives for active management, while having them assume appropriate levels of risk. From this viewpoint, we plan to incorporate a medium- to long-term performance linked remuneration based on stock compensation scheme into the remuneration system that is currently composed of fixed remuneration and short-term performance linked remuneration. In resolving proposals regarding nomination and remuneration, we make decisions after the prior deliberation at the Nomination and Remuneration Advisory Committee with a majority of the members being Independence of outside directors, in order to ensure transparency and fairness of the decision-making process of the Board of Directors.

Criteria for Determining the Independence of Outside Directors and Outside Audit & Supervisory Board Members and Their Qualifications

The Company has established the “Criteria for Determining the Independence of Outside Directors”. In accordance with this standard, the Company confirms that the independence of candidates for independent outside directors is secured in terms of their substance as well as their qualifications, background and knowledge.

Criteria for Determining the Independence of Outside Directors

| Item/Standards | Requirements concerning past years Requirements concerning relatives |

|

|---|---|---|

| 1 | 【Item】 A major business partner of the Group or an executor of business thereof 【Standard】 A business partner whose amount of transactions accounted for more than 2% of the Group’s consolidated net sales in the immediately previous fiscal year |

●A person who has fallen under any of the items on the left in the past three years ●A relative within second degree of kinship to a person who falls under any of the items on the left |

| 2 | 【Item】 A person whose major business partner is the Group or an executor of business thereof 【Standard】 A person whose amount of transactions to the Group accounted for more than 2% of the person’s consolidated net sales or total revenue in the immediately previous fiscal year |

|

| 3 | 【Item】 A principal shareholder of the Company or an executor of business thereof in the case that such shareholder is a corporation 【Standard】 A person who, directly or indirectly, owns 10% or more of all the voting rights of the Company |

|

| 4 | 【Item】 A consultant, accounting professional such as a certified public accountant or legal professional such as an attorney-at-law who receives money or other financial benefit from the Group excluding remuneration for director/audit & supervisory board member. (If a corporation or an association, etc. receives such financial benefit, a person who is affiliated with such organization) 【Standard】 A person who received financial benefit amounting to more than 10 million yen from the Group, excluding remuneration for director/audit & supervisory board member in the immediately previous fiscal year |

|

| 5 | 【Item】 A person who receives a large amount of donations from the Group or an executor of business thereof 【Standard】 A person who received financial benefit amounting to more than 10 million yen from the Group in the immediately previous fiscal year |

|

| 6 | 【Item】 An executor of business of a company of which the Group is a principal shareholder 【Standard】 A person of which 10% or more of all the voting rights is owned by the Group |

|

| 7 | 【Item】 A financial institution that is a principal lender to the Group or an executor of business of the parent or a subsidiary of such financial institution 【Standard】 A financial institution from which borrowings at the end of the immediately previous fiscal year accounted for more than 2% of the Company’s consolidated total assets |

|

| 8 | 【Item】 Other 【Standard】 A person with special reasons that prevent him/her from fulfilling duties as an Independent Outside Director/Audit & Supervisory Board Member, such as those that may cause conflict of interests with the Company |

- |

* If none of the above attributes applies to an Outside Director/Audit & Supervisory Board Member, the Company judges that such Outside Director/Audit & Supervisory Board Member is independent from the Company.

Preconditions to Ensure Effectiveness of the Board of Directors

The Company regularly has each Director carry out self-evaluations and conducts surveys to analyze and evaluate the overall effectiveness of the Board of Directors. Directors perform self-evaluations on the respective categories of 1. Structure of the Board of Directors; 2. Operational status of the Board of Directors; 3. Decision making process; 4. Support structure for Outside Directors; and 5. External communication. The results are reported to the Board of Directors and deliberated upon, and verification is conducted to understand the condition of the Board of Directors, as well as the legitimacy and appropriateness of its way of operating.

Basic Policy of Diversity

Irrespective of race, nationality, creed, gender, physical impairment and others, we have acquired and appointed diverse human resources based on our policies of employment stability and equal opportunities. While responding to the social demands as represented by the enforcement of Expansion of Women’s Participation in Policy and Decision-making Processes in All Fields in Society, we aim to encourage independence and self-reliance of each employee through various trainings and internal educational opportunities. We also promote the establishment of personnel system that can respond to diverse working styles and fair treatment based on the degree of contribution to the company, in addition to our ongoing efforts to enhance the respect for humanity and secure comfortable working environment.

Basic Policy of Directors’ Training

The Company prepares a training plan for the management team including newly appointed officers and directors. In order to acquire knowledge on businesses, finance, organizations, and other fields necessary for fulfilling their roles and responsibilities of directors, we provide appropriate trainings as necessary such as seminars led by external experts.

Skills Matrix

In order to realize the Company's corporate philosophy and management plan and enhance the corporate value of the Company and the Group, the Company has identified six skills that it expects from Directors: (1) management experience, (2) global perspective, (3) sales and marketing, (4) treasury, accounting, and finance, (5) legal affairs and compliance, and (6) sustainability and governance. The skills possessed by each Director is as below

| Name | Position | Corporate management | Global business | Sales/ Marketing | Finance/ Accounting | Legal/ Compliance | Sustainability/ Governance | |

|---|---|---|---|---|---|---|---|---|

| Hironobu Takashita | President and CEO | 〇 | 〇 | 〇 | 〇 | 〇 | ||

| Masahito Adachi | Director and Senior Executive Officer | 〇 | 〇 | 〇 | 〇 | |||

| Satoshi Nishimura | Director and Senior Executive Officer | 〇 | 〇 | 〇 | 〇 | |||

| Shinji Urade | Director and Executive Officer | 〇 | 〇 | 〇 | 〇 | |||

| Jun Takahashi | Director and Officer | 〇 | 〇 | 〇 | 〇 | |||

| Yoshio Tano | Outside Director (Independent Officer) | 〇 | 〇 | 〇 | ||||

| Yasuyuki Watanabe | Director and Audit & Supervisory Committee Member | 〇 | 〇 | 〇 | 〇 | |||

| Hiroko Kaneko | Outside Director and Audit & Supervisory Committee Member (Independent Officer) | 〇 | 〇 | 〇 | ||||

| Miyuki Nakagawa | Outside Director and Audit & Supervisory Committee Member (Independent Officer) | 〇 | 〇 | 〇 | ||||